FTC scrutinizes PBMs in new report Top three PBMs processed nearly 80% of prescriptions dispensed by U.S. pharmacies in 2023

By HME News Staff

Updated 1:10 PM CDT, Tue July 9, 2024

WASHINGTON – The Federal Trade Commission has published an interim report that underscores the impact pharmacy benefit managers have on accessibility and affordability of prescription drugs.

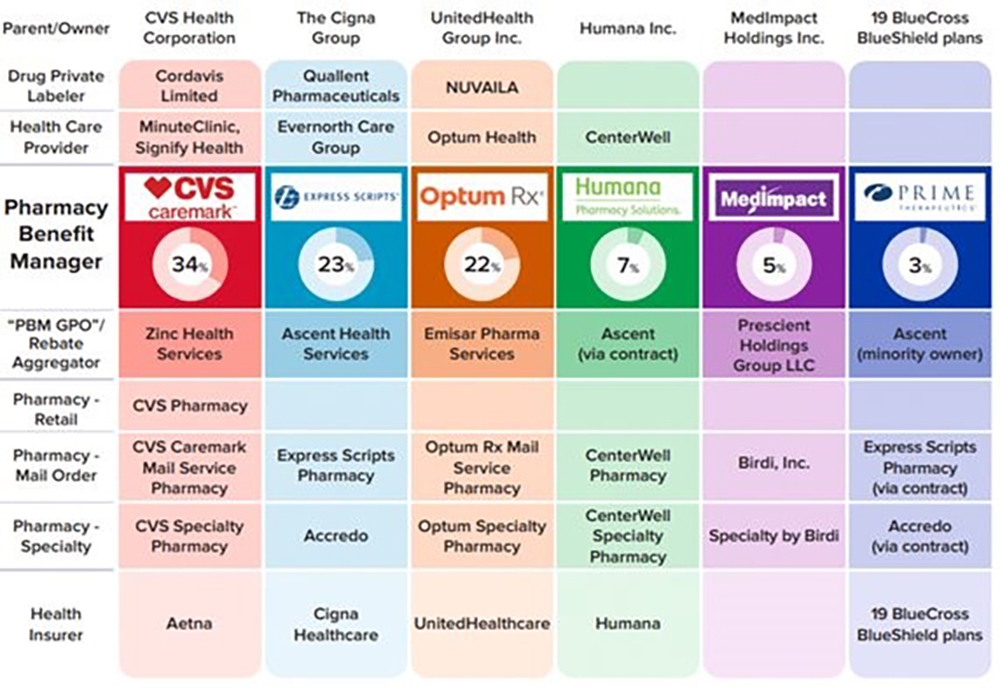

The FTC’s report, which is part of an ongoing inquiry launched in 2022, details how increasing vertical integration and concentration has enabled the six largest PBMs to manage nearly 95% of all prescriptions filled in the United States. This market structure has allowed PBMs to profit at the expense of patients and independent pharmacists, according to the report.

“The FTC’s interim report lays out how dominant pharmacy benefit managers can hike the cost of drugs—including overcharging patients for cancer drugs,” said FTC Chair Lina M. Khan. “The report also details how PBMs can squeeze independent pharmacies that many Americans—especially those in rural communities—depend on for essential care. The FTC will continue to use all our tools and authorities to scrutinize dominant players across health care markets and ensure that Americans can access affordable health care.”

The FTC launched an inquiry into the prescription drug middleman industry in 2022.

The report highlights several key insights gathered from documents and data obtained from the FTC’s orders to Caremark Rx; Express Scripts; OptumRx; Humana Pharmacy Solutions; Prime Therapeutics; MedImpact Healthcare Systems, Zinc Health Services, Ascent Health Services and Emisar Pharma Services, as well as from publicly available information:

-

Concentration and vertical integration: The market for PBMs has become highly concentrated, and the largest PBMs are now also vertically integrated with the nation’s largest health insurers and specialty and retail pharmacies. The top three PBMs processed nearly 80% of the approximately 6.6 billion prescriptions dispensed by U.S. pharmacies in 2023, while the top six PBMs processed more than 90%. Pharmacies affiliated with the three largest PBMs now account for nearly 70% of all specialty drug revenue.

-

Significant power and influence: As a result of this high degree of consolidation and vertical integration, the leading PBMs now exercise significant power over Americans’ ability to access and afford their prescription drugs. The largest PBMs often exercise significant control over what drugs are available and at what price, and which pharmacies patients can use to access their prescribed medications. PBMs oversee these critical decisions about access to and affordability of life-saving medications, without transparency or accountability to the public.

-

Self-preferencing: Vertically integrated PBMs appear to have the ability and incentive to prefer their own affiliated businesses, creating conflicts of interest that can disadvantage unaffiliated pharmacies and increase prescription drug costs. PBMs may be steering patients to their affiliated pharmacies and away from smaller, independent pharmacies. These practices have allowed pharmacies affiliated with the three largest PBMs to retain high levels of dispensing revenue in excess of their estimated drug acquisition costs, including nearly $1.6 billion in excess revenue on just two cancer drugs in under three years.

-

Unfair contract terms: Evidence suggests that increased concentration gives the leading PBMs leverage to enter contractual relationships that disadvantage smaller, unaffiliated pharmacies. The rates in PBM contracts with independent pharmacies often do not clearly reflect the ultimate total payment amounts, making it difficult or impossible for pharmacists to ascertain how much they will be compensated.

-

Efforts to limit access to low-cost competitors: PBMs and brand drug manufacturers negotiate prescription drug rebates some of which are expressly conditioned on limiting access to potentially lower-cost generic and biosimilar competitors. Evidence suggests that PBMs and brand pharmaceutical manufacturers sometimes enter agreements to exclude lower-cost competitor drugs from the PBM’s formulary in exchange for increased rebates from manufacturers.

The report notes that several of the PBMs that were issued orders have not been forthcoming and timely in their responses, and they still have not completed their required submissions, which has hindered the FTC’s ability to perform its statutory mission. The commission's staff have demanded that the companies finalize their productions required by the 6(b) orders promptly. If, however, any of the companies fail to fully comply with the 6(b) orders or engage in further delay tactics, the FTC can take them to district court to compel compliance.

The Commission voted 4-1 to allow staff to issue the interim report, with Commissioner Melissa Holyoak voting no. Chair Lina M. Khan issued a statement joined by Commissioners Rebecca Kelly Slaughter and Alvaro Bedoya. Commissioners Andrew N. Ferguson and Melissa Holyoak each issued separate statements.

Comments