Disaster relief: Industry tries to ‘connect’ dots

By Theresa Flaherty, Managing Editor

Updated 7:55 AM CDT, Wed September 25, 2024

- Collaboration and data collection: A virtual meeting highlighted the importance of connecting stakeholders, including the Red Cross and FEMA, to better utilize HME providers during disasters. However, more and better data is needed to influence policy and reimbursement changes.

-

Challenges in reimbursement: Despite efforts, CMS has not changed payment policies for disaster-related costs. The industry must document and share detailed cost information to advocate for additional payments.

YARMOUTH, Maine – With natural disasters seemingly increasing in frequency and scope, the role of HME providers is taking on greater significance, but more work needs to be done to raise awareness of what they do and why they should be paid for it.

A recent virtual meeting hosted by Tangita Damarola, CMS’s competitive acquisition ombudsman, brought together the DMEPOS community and stakeholders and associates from the Red Cross, the Federal Emergency Management Agency and the Administration for Strategic Preparedness & Response, a division of Department of Health and Human Services.

“Mostly, we were just trying to connect each other,” said Emily Harken, business operations manager for VGM Government Relations, who also sits on VGM’s DMEPOS Emergency Preparedness Group, “(That way) they know who we are. We have our needs during disasters, but also, they can utilize us. We're here on the front lines, beside hospitals and doctors, and we're here to help.”

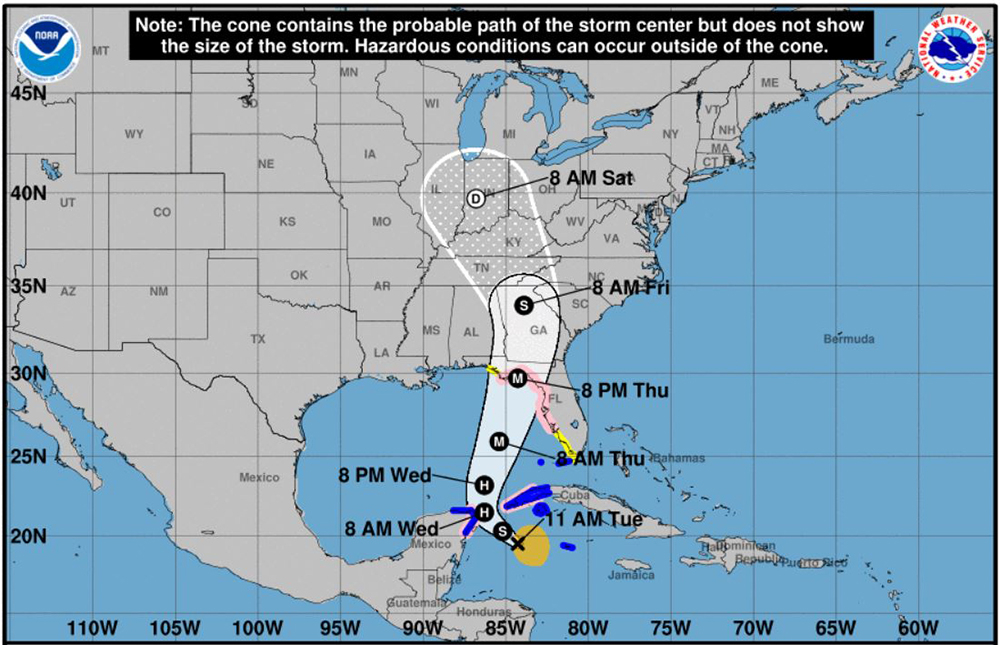

At press time, for example, providers in Florida and Georgia were bracing for Tropical Storm Helene to hit the state’s Gulf Coast and travel northward as a major Category 3 hurricane.

Provider Chris Townsend, who has participated in the DMEPOS Emergency Preparedness Group and is a veteran of Florida hurricanes, says more – and better – data needs to be gathered if there is any hope of meaningful policy or reimbursement change in the future.

“CMS has been engaged on this issue for years, but I don’t think any action that impacts the provider has been taken because there isn’t the data,” said Townsend, owner of Palm Coast, Fla.-based Be Active. “We’ve provided them data, feedback from surveys and the high-level things that have happened post-disaster, but because providers aren’t fast enough to put proper modifiers on claims, that data coming through is looked at by Medicare as low or insignificant.”

That in turn means the biggest challenge for providers – getting reimbursed for the additional costs incurred during a disaster – remains an uphill battle, say stakeholders.

“CMS has not changed anything in terms of payment,” said Kim Brummett, senior vice president of regulatory affairs for AAHomecare. “The industry challenge is to document and share exactly what these costs are to CMS in the hopes that some additional payment can be made.”

In a small step in the right direction, FEMA recently updated an online disaster planning tool to include a field to collect DME information from patients like equipment make and model, if it is lost or damaged and needs to be replaced.

“If a patient is filling this out any way, hopefully they will also put, for example, if they have oxygen needs so CMS has a record of who is needing help during a disaster,” said Harken.

Learn more about the DMEPOS Emergency Preparedness Group.

- Related: As natural disasters increase, so do out-of-pocket costs.

- Related: Providers in Hawaii go above and beyond during Maui’s devastating wildfires.

Comments